On 30th September Lloyd’s of London published their vision for the Future at Lloyd’s. Here at r10, we have undertaken a detailed study of the contents of Blueprint One and in the eighth of a series of bite-sized articles look at the proposals for the use of data and how it may impact your business.

What is the strategic intent for data?

The Future at Lloyd’s programme relies on the timely availability of quality data throughout a risk’s lifecycle to drive downstream processes and services, reduce costs and improve client outcomes. It is therefore essential that appropriate data standards and frameworks are defined to ensure that value can be released.

What value can be released by taking this data-centric approach?

The future plans for the complex risks platform and risk exchanges rely on the codification of placement and policy data to enable:-

- Improved placement efficiency

By capturing structured data at the beginning of the placement process the need to re-key the data is reduced, and data augmentation services can be used to further improve efficiencies. - Better risk insights and improved customer outcomes

The data collected can be available to analytics and machine learning algorithms helping improve coverage and recommend products that meet the client’s needs. - Automated common services

Timely, validated, standardised data will be used to feed common services, such as AML / KYC / Sanctions checking, reducing duplication. - Enables the Claims solution

Structured risk data will enable the triaging of claims and automation of valid, low-value claims. - Product innovation

Core data will be available to drive deeper insights & support produce development.

How will this be achieved?

To enable the value release outlined in Blueprint One, the corporation will define a number of core services and components:

- Data framework

The Corporation will consult with the market but ultimately own & maintain the data framework. - Data quality and standards

To achieve the interoperability of systems outlined on the Blueprint, the Corporation will work with the London market to ensure that minimum data and quality standards are defined, published and enforced. - Data governance & security

The ownership and use of data will be clearly defined for each solution. Advanced technology will be used to secure the data and ensure that regional data jurisdiction needs will be met. - Additional data services

Lloyd’s plan to offer a range of data enrichment and analysis tools, reducing the amount of data required to be uploaded to the system. - Common data platform

A common data platform will hold the definitive record for the lifecycle of every risk (Risk, MTA, Premium, Claims etc)

What is the proposed timeline?

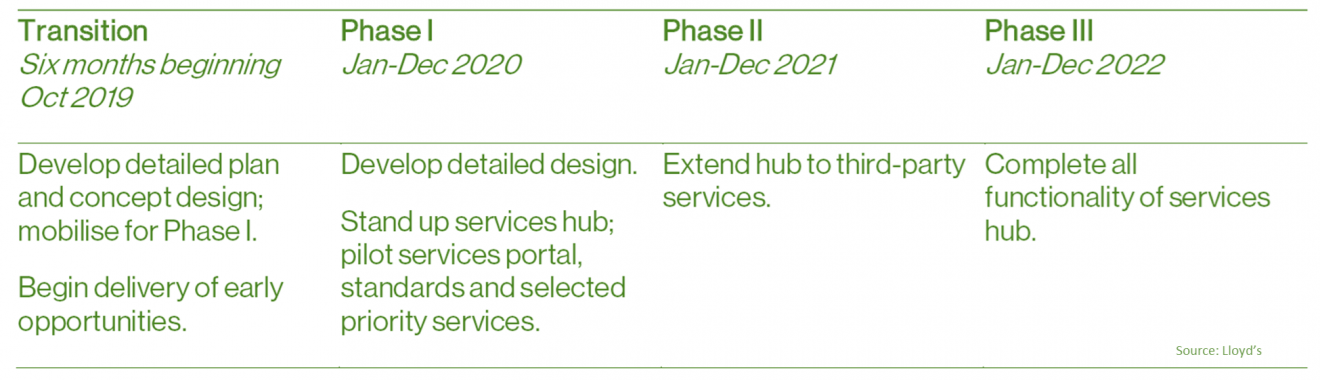

The transition to a data-first marketplace will not happen overnight. There are many dependencies across the Future at Lloyd’s programme that will affect the pace of change. Lloyd’s have published the timeline below for consideration: –

Will there be a need to backload/migrate existing policies?

The Blueprint One document is clear that there are no immediate plans to require existing policies to be migrated over, however, as thinking matures ideas may be developed at some time in the future.

How will the new approach to data impact your business?

The core theme of Blueprint one is the transition to a data-centric marketplace. The evolution of shared-services, data augmentation and, eventually, data first placement platforms will require all market participants to review their data strategies and better understand the core skills their workforce will need to meet the data-challenge.

Risk and compliance departments will need to review the proposals to ensure that they understand and are comfortable with the changes to the risk landscape and be aware of potentially new exposures.

Technology vendors will need to review and adapt their platforms to embrace the emergent data standards, to ensure re-keying is minimised & that their technology will be able to seamlessly integrate with the shared services through API’s

How r10 can help

With our in-depth London Market expertise, r10 is uniquely placed to help guide your organisation through the Future at Lloyd’s change programme and over the coming weeks will be updating our blog with insights & guidance on what the changes may mean for you.

Please get in touch for more information on how r10 can help you prepare to play your part in the market of the future.

Read the next bite-sized article in our Bite-sized series “How would the future of Lloyd’s use technology?”, which is the ninth out of the twelve proposed Future of Lloyd’s capabilities.

Author: Chris Carney