The Core Data Record explained – v3.0.

What do we know about CDR?

- The CDR is the data required for processing accounting and settlement, tax, regulatory reporting and first notification of loss

- It has a set of consistent naming conventions and formats

- It covers all open Market and facultative risks, irrespective of class of business (Delegated Authority and Treaty risks will follow in early 2023, followed by Claims)

- It is not all the data required to place the risk

- The CDR data comes from 4 sources: the MRC, the schedule of values (SoV), tax schedules and a data jacket (additional data that is required over and above the MRC)

What are the main changes compared to today? – Most of the data is already being collected today, but there are some differences.

- The provision of data is required earlier in the placing and settlement process in order to satisfy the 4 use cases

- The additional insureds must be listed with address information for several countries and insurable interest types

- The sub-set of SoV data is required at bind:numbers (over 24ft), engine indicators & gross tonnage for Marine; tail number and weight for Aviation; weight of Spanish vehicles and address information for Fixed Property, Marine and Aviation (ports of registration or primary operation)

- It will be key to understand the role of the list of values for insurable interests as it relates to the granularity of data needed for tax calculations

What does the CDR cover?

V3 of the CDR was approved by the Data Council back in March 2022. Subsequent to this, further work on the CDR has landed on circa 200 fields. The further work here being the alignment of the CDR to the ACORD Global Placing Message (GPM) to create a GPM+ message, which is a sub-set of the overall global set of standards specifically for London.

The CDR can be found here: https://airtable.com/shrooMfVtLJCZdTQE

What does that mean?

The CDR is circa 200 fields to accommodate every flavour of risk: coverage and territory of Open Market and FAC RI risks written in the London Market.

Whilst there are circa 200 fields, even with the most complex of permutations, circa 130-140 fields are a likely maximum per risk, with circa 80 fields for an average risk.

Kirstin Duffield, Technical Advisor to the Chair of the Data Council, explains in a summary

The most complex risk that could be made up for illustrative purposes is approximately 130-140 fields. A risk with Spanish or Canada policyholders, intermediaries in Germany or Denmark, and location for tax risk in several EU countries or Australia and both Lloyd’s and non-Lloyd’s carriers in UK and EU, with a tax administered by one of those Danish or German intermediaries, using either Marine, Aviation, or Fixed Property will give you a maximum use of the CDR.

The simplest risk for illustrative purposes could be a single Isle of Man property fac risk with no associated taxes, deductibles, fees, discounts or commissions. This applies to both the company market (53 CDR fields) and Lloyd’s Market (61 CDR fields).

Looking at average with some taxes, some intermediaries, circa 90-130 fields per risk seems a reasonable view, most of which are in the MRC somewhere in some format.

Understanding the CDR – v3.0

Drilling into the detail of the CDR, it is to understand what data is required, its format, how it must be presented, and in which contexts the data are required:

- Mandatory fields: the v3.0 CDR has 45 mandatory fields. Those fields are required for every risk type

- Field formats: of those 45 fields, there is inception and expiry date. Along with the time zone to be specified, the date format is also specified as YYYY-MM-DD HH:MM:SS

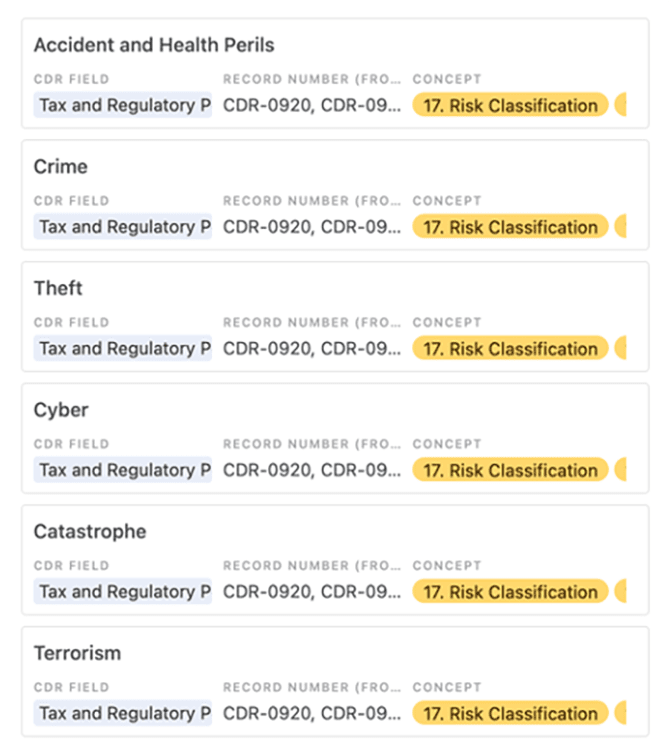

- Reference lists: for certain fields, there are pre-defined dropdown or reference lists. For example: “Tax and Regulatory Perils – Included” – there are 45 different options in the dropdown list, Fig 1 shows an example of list of these values taken from Airtable:

- Conditional mandatory fields: there are 112 conditional mandatory fields. Fields that may or may not be required depending on the territory and coverage of the risk.

- Derived fields: there are 21 derived fields

Note: v3 of the CDR will be superseded by v3.2 in early 2023 due to the alignment of the CDR to the ACORD messaging frameworks. This is currently going through the market approval process.

Next steps.

After understanding more about CDR, next would be to understand the implementation journey and challenges for the organisation.

In a recent blog by Sheila Cameron, Chair of the Data Council, she encouraged the following:

So, my call in our Market as we move towards 2023 is please put on your thinking hats and do three things.

- Start by aligning your in-house data to the GRLC standard

- Get ready to align your in-house systems to the MRC v3 standard that will be available in late Q1

- And then, much more than that, now is the time to start to think about what you and your firm want to do with data, where you want it to flow and what insights you want to be able to make use of; or how you can use this programme to manage costs. Every firm needs an API strategy, or a software provider who can help them develop one

There is no “no action” option, but there are several ways to address these changes; all depending on the digital and data aspiration of the organisation, the transaction volumes, business cases, budget, and talent and most importantly, culture.

We have been working with our clients to help them make informed decisions on their strategy, and implement a CDR validation ecosystem depending on the path they choose: from digital and data-first, document-led and anywhere in between.

In our next blog, Hélène Stanway, r10’s Director of Advisory, explores the options of digital and data-first, and document-led approaches as strategic priorities.

Get in touch with r10’s Advisory team to help you comprehend further CDR, and your Future@Lloyd’s digital transformation journey, including understanding, defining and implementing your strategic priorities.