The Core Data Record explained – v3.2

What do we know about CDR?

- The CDR is the data required for processing accounting and settlement, tax, regulatory reporting and first notification of loss

- It has a set of consistent naming conventions and formats

- It covers all open Market and facultative risks, irrespective of class of business (Delegated Authority and Treaty risks will follow in 2023, alongside by Claims and Endorsements)

- It is not all the data required to place the risk

- The CDR data comes from 4 sources: the MRC, the schedule of values (SoV), tax schedules and a data jacket (additional data that is required over and above the MRC)

- Every CDR field has a stage of availability, where the two stages are:

- At Bind i.e. when the written line goes down – this may also be referred to as ‘part 1 data’

- Prior to settlement i.e just before the receipt of a Technical Account (TA) – this may also be referred to as ‘part 1 data’

- The data from both stages must be present and complete and correct for the CDR to be accepted into the JV Digital Risk Processing Service – Gateway (also called IROS = International Risk Orchestration System)

- The CDR can only be submitted to the Digital Gateway via an API

- The Digital Gateway will ingest, validate, enrich and store the CDR. It will be from there that the CDR can be extracted and will have the various required reports

What are the main changes compared to today? – Most of the data is already being collected today, but there are some differences.

- The provision of data is required earlier in the placing and settlement process in order to satisfy the 4 use cases

- The additional insureds must be listed with address information for several countries and insurable interest types

- The sub-set of SoV data is required at bind:numbers (over 24ft), engine indicators & gross tonnage for Marine; tail number and weight for Aviation; weight of Spanish vehicles and address information for Fixed Property, Marine and Aviation (ports of registration or primary operation)

- It will be key to understand the role of the list of values for insurable interests as it relates to the granularity of data needed for tax calculations

What does the CDR cover?

The CDR v3.2 has 232 fields with 37 mandatory fields, 180 conditional mandatory and 15 derived fields.

The CDR v3.2 and MRC v3 can be found here: www.lloyds.com/conducting-business/requirements-and-standards/core-data-record

What does that mean?

- The CDR is 232 fields to accommodate every flavour of risk: coverage and territory of Open Market and FAC RI risks written in the London Market.

- Whilst there are 232 fields, even with the most complex of permutations, circa 130-140 fields are a likely maximum per risk, with circa 80 fields for an average risk.

Understanding the CDR – v3.2

Drilling into the detail of the CDR, it is to understand what data is required, its format, how it must be presented, and in which contexts the data are required:

Mandatory fields: the v3.2 CDR has 37 mandatory fields. Those fields are required for every risk type

Field formats: of those 37 fields, there is inception and expiry date. Along with the time zone to be specified, the date format is also specified as YYYY-MM-DD HH:MM:SS

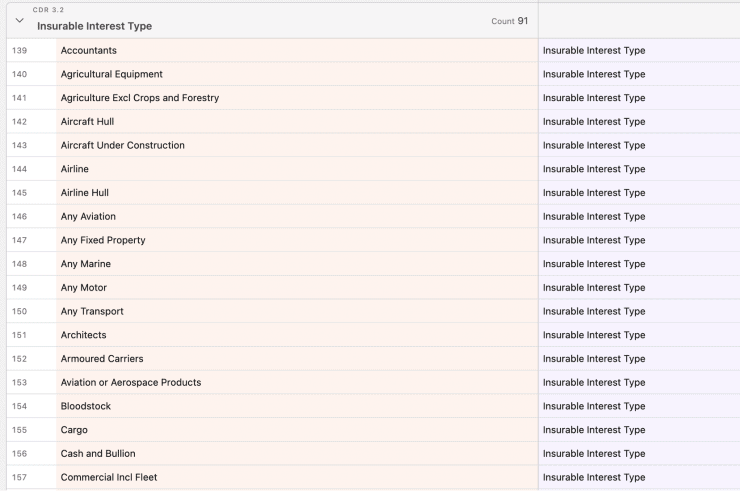

Reference lists: for certain fields, there are pre-defined dropdown or reference lists. For example: “Insurable Interest Type” – there are 91 different options in the dropdown list, Fig 1 shows an example of list of these values taken from Airtable:

- Conditional mandatory fields: there are 180 conditional mandatory fields. Fields that may or may not be required depending on the territory and coverage of the risk.

- Derived fields: there are 15 derived fields

Get in touch with r10’s Advisory team to help you comprehend further CDR, and your Future@Lloyd’s digital transformation journey, including understanding, defining and implementing your strategic priorities.